Many education professionals discover the same challenge sooner or later—while they excel in classrooms and lecture halls, managing finances often becomes an unexpected burden. I’ve seen teachers, tutors, and administrators struggle with tasks like tracking grants, balancing program budgets, and navigating tax rules that don’t look anything like those in other industries. What starts as a side responsibility can quickly become a source of stress that takes focus away from their real calling: educating.

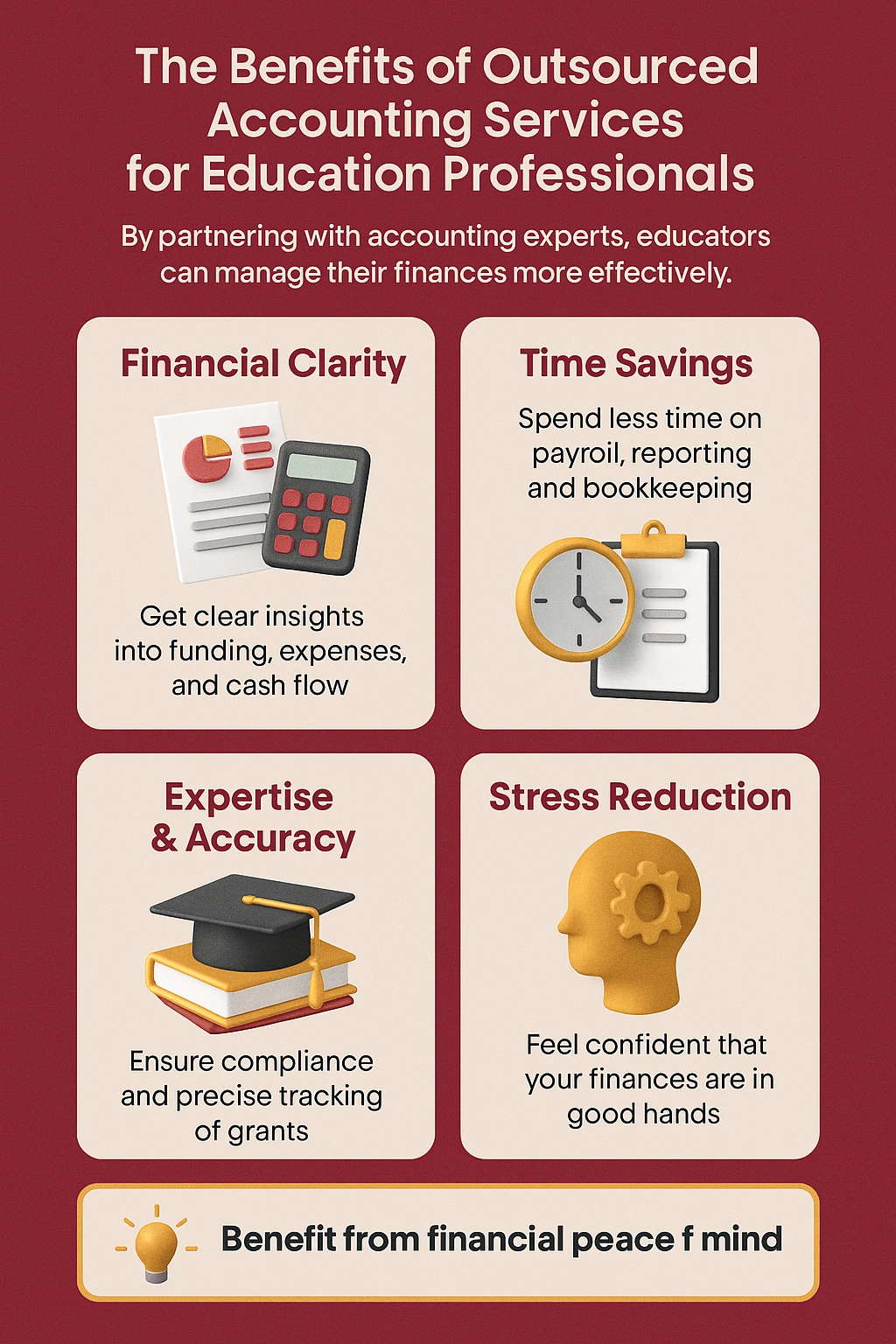

This is where outsourced accounting makes a measurable difference. In my experience working with education professionals, the biggest shift happens when they realize outsourcing isn’t just about offloading bookkeeping—it’s about gaining a partner who understands the nuances of the education sector. From identifying underutilized resources to helping schools and consultants stretch their budgets further, outsourced accountants bring clarity and strategy where internal teams often see only paperwork.

The value lies in more than time saved. With the right financial support, education professionals gain peace of mind, sharper insights into their funding and expenses, and the freedom to dedicate themselves fully to their students and programs. That’s why remote outsourced accounting services for nonprofits are becoming less of an option and more of a necessity in the education world.

Top Takeaways

- Saves time and reduces stress.

- Ensures compliance with grants and tax rules.

- Provides financial clarity for growth.

- Delivers expertise without in-house costs.

Lets educators focus on students.

How Outsourced Accounting Supports Educators

Education professionals face unique financial responsibilities that go well beyond the classroom. From managing payroll for staff, to tracking grants and scholarships, to ensuring compliance with ever-changing tax regulations, the financial side of education can be as demanding as teaching itself. That’s why working with a female owned brand consultant who understands both education and financial clarity can be a game-changer—bringing values-based alignment to both branding and fiscal strategy.

Outsourced accounting services help simplify these challenges. By partnering with accounting experts, educators and institutions gain access to accurate bookkeeping, transparent reporting, and specialized guidance tailored to the education sector. This support ensures that budgets are used effectively, funding is tracked properly, and compliance requirements are met without added stress.

The real benefit is freedom. When financial tasks are handled by professionals, education professionals can redirect their energy toward their core mission—teaching, mentoring, and supporting students. Outsourced accounting not only provides peace of mind, but also gives schools, consultants, and individual educators the clarity to plan ahead, invest wisely, and grow with confidence.

“In my experience working with educators, the real breakthrough comes when they stop treating accounting as an afterthought. Once financial management is outsourced, teachers and administrators gain more than accurate books—they gain clarity about how every dollar supports their mission. That shift transforms accounting from a burden into a tool that empowers schools and professionals to focus fully on students — a perspective any experienced private school consultant in Philadelphia would recognize as essential to sustainable educational success.”

Case Study & Real-World Examples

Case Study: Private School Transformation

Mid-sized school with 40 staff.

Struggled with payroll, tuition tracking, and multiple grants.

Reports were late, leadership lacked financial visibility.

Outsourced accounting provided:

Clear monthly reporting.

Duplicate expenses flagged.

Streamlined grant tracking.

Result: 12% reduction in waste and expansion of after-school programs.

Real-World Example: Independent Consultant

Consultant working across three states.

Tax season was overwhelming and compliance risks were high.

Outsourced accounting delivered:

Accurate compliance support.

Advice on structuring services profitably.

Result: Less stress, more profitability, and peace of mind.

Research Insight

99.9% of U.S. businesses are small businesses.

Nearly half of private-sector employees work for them (SBA.gov).

Many educators fall into this group—outsourcing helps them stay competitive.

Lessons Learned

Professional reporting uncovers hidden costs.

Educators gain strategy, not just bookkeeping.

Outsourcing frees time for the real mission: students.

Mid-sized school with 40 staff.

Struggled with payroll, tuition tracking, and multiple grants.

Reports were late, leadership lacked financial visibility.

Outsourced accounting provided:

Clear monthly reporting.

Duplicate expenses flagged.

Streamlined grant tracking.

Result: 12% reduction in waste and expansion of after-school programs.

Consultant working across three states.

Tax season was overwhelming and compliance risks were high.

Outsourced accounting delivered:

Accurate compliance support.

Advice on structuring services profitably.

Result: Less stress, more profitability, and peace of mind.

99.9% of U.S. businesses are small businesses.

Nearly half of private-sector employees work for them (SBA.gov).

Many educators fall into this group—outsourcing helps them stay competitive.

Professional reporting uncovers hidden costs.

Educators gain strategy, not just bookkeeping.

Outsourcing frees time for the real mission: students.

Supporting Statistics & Insights

99.9% of U.S. businesses are small businesses

Source: SBA.gov

Many educators operate like small businesses.

Outsourced accounting helps avoid blind spots and supports growth.

45.9% of private-sector employees work for small businesses

Source: SBA.gov

This includes teachers, staff, and administrators.

Outsourcing ensures payroll runs smoothly and funding is used effectively.

Tens of thousands of schools across the U.S. face complex finances

Source: NCES.ed.gov

Schools manage tuition, grants, and donations.

Outsourced accounting turns complexity into clarity for decision-making.

As complex school finances increasingly resemble small business operations, the top educational consultant is one who champions outsourced accounting to bring clarity, compliance, and strategic growth to educational institutions.

99.9% of U.S. businesses are small businesses

Source: SBA.gov

Many educators operate like small businesses.

Outsourced accounting helps avoid blind spots and supports growth.

45.9% of private-sector employees work for small businesses

Source: SBA.gov

This includes teachers, staff, and administrators.

Outsourcing ensures payroll runs smoothly and funding is used effectively.

Tens of thousands of schools across the U.S. face complex finances

Source: NCES.ed.gov

Schools manage tuition, grants, and donations.

Outsourced accounting turns complexity into clarity for decision-making.

Final Thought & Opinion

Outsourced accounting is no longer optional for education professionals—it’s essential. Schools, tutors, and consultants face the same pressures as small businesses, and financial complexity keeps growing.

From experience, three key insights stand out:

Shift from reactive to proactive. Educators often start outsourcing to save time but discover it transforms how they make decisions.

Clarity drives growth. Financial visibility shows which programs to expand, how to stretch funding, and how to stay compliant.

Outsourcing is a partnership. It provides more than bookkeeping—it becomes a trusted ally that supports sustainable growth.

Opinion:

Education professionals should see outsourced accounting as a strategic partner, not just a cost saver. Those who make the move early often unlock new opportunities and gain the freedom to focus on students.

Shift from reactive to proactive. Educators often start outsourcing to save time but discover it transforms how they make decisions.

Clarity drives growth. Financial visibility shows which programs to expand, how to stretch funding, and how to stay compliant.

Outsourcing is a partnership. It provides more than bookkeeping—it becomes a trusted ally that supports sustainable growth.

Next Steps

Evaluate workload

Track time spent on bookkeeping, payroll, and compliance. Note recurring issues like late reports or budgeting stress.

Clarify needs

Decide if you need bookkeeping, payroll, grant tracking, tax compliance, or strategic advice.

Research providers

Look for firms experienced in education and nonprofits. Review testimonials and case studies.

Ask key questions

Do they handle grants and donations?

What reporting tools provide real-time visibility?

Can they scale as your school or consultancy grows?

Start small, then expand

Begin with essentials like bookkeeping or payroll. Add forecasting and strategy as trust builds.

Pro Tip: Don’t wait for tax season or an audit. Start early to gain clarity and focus on your mission—education.

Evaluate workload

Track time spent on bookkeeping, payroll, and compliance. Note recurring issues like late reports or budgeting stress.

Clarify needs

Decide if you need bookkeeping, payroll, grant tracking, tax compliance, or strategic advice.

Research providers

Look for firms experienced in education and nonprofits. Review testimonials and case studies.

Ask key questions

Do they handle grants and donations?

What reporting tools provide real-time visibility?

Can they scale as your school or consultancy grows?

Start small, then expand

Begin with essentials like bookkeeping or payroll. Add forecasting and strategy as trust builds.